Kevin John Bradford Wilbur is the President and Founder of ProtectVEST and AdvanceVEST By EchoVectorVEST MDPP Precision Pivots. He is also the Chief Architect of the Motion Dynamics and Precision Pivots Forecast Model and Alert Paradigm, and the Senior Developer of the ProtectVEST and AdvanceVEST Active Advanced Position and Risk Management Trade Technology and Active Advanced Position Management And Capital Gain Return Optimization Methodology.

Kevin is a prize-winning Economist (Governor's Fellow) and Financial Physicist with an over 45 year span of experience and awards in Academics, Research, Management, Practice and Trade. Kevin has specialized experience in the Major Market Indexes, Commodities, ETFs, and in derivatives and the derivatives markets.

Kevin received his Masters Degree in Economics from George Mason University, where he also served as the President of The Theta Chapter of Omicron Delta Epsilon, The International Economic Honorary. At GMU, Kevin was awarded The Virginia Graduate Scholarship, and also served prestigiously as a Governor's Fellow in Economics.

Kevin also attended The USDA Graduate School, where also excelling, he focused on Commodity Price and Program Management Techniques in service to US National Interests. With economic security clearances at USDA, Kevin served within the Agricultural Policy Analysis Group at ERS (Economic Research Service) and within Program Administration Divisions at ASCS (Agricultural Stabilization and Conservation Service). He also served to support CCC (Commodity Credit Corporation) economic forecasts, CCC commodity price discovery and stabilization efforts, and CCC contract awards.

While at USDA, Kevin was awarded the "USDA Certificate Of Merit Award" for performance excellence and his contributions and service to the National Interest at a time of peak need.

Kevin has served as Founder, President, Senior Market Analyst and Senior Market Strategist of ProtectVEST by EchoVectorVEST, a Division of Motion Dynamics and Precision Pivots, Bradford Market Research and Analytics*

In forecasting and anticipating the market crash of 2008 and 2009 beforehand in 2007, Kevin enabled prepared parties the prevention of significant equity value loss those years. And his subsequent market forecast of the following March 2009 major market lows proved equally as 'valuable.' (Kevin forecasted and identified the March 10, 2009, 're-entry point' to the day).

In 2010 Kevin went on to successfully forecast and identify the subsequent intermediate-term market top of mid-April enabling high market price level insurance locks. He also forecasted and identified the early September re-entry point later that year, for the re-introduction of powerfully productive full net long and double-long market exposures.

In 2011 Kevin's market forecasts continued with truly remarkable and outstanding results, and his Market-timed Alerts guided to an amazing 130 percent annual increase on a Dow 30 Industrials Composite Average Price Equivalency Basis that year!

In 2012 Kevin's market forecasts were even more impressive, with the MDPP Model forecasting over triple the effective returns of 2011! Kevin made and issued pivotal forecasts for the Major Market Large Cap Stock Indexes, the Gold Metals Markets, and the North American Crude Oil Markets (his three select and primary foci) with further outstanding results and success.

Interest in Kevin's forecasts grew significantly the following years! And during the bull market run through 2019, Kevin continued with his exceptionally impressive pace of forecast results!

And, remarkably, in 2020 on February 2ND Kevin warned of the Chinese Equities Market collapse! Then, on February 18TH 2020, Kevin called for the application of FULL price level hedge insurance on US Broad Market Index Equities exposures by Wednesday February 19TH of its 2020 peak week (again enabling prepared parties the prevention of significant equity value loss into latter March 2020)!

Then in March of 2020 Kevin forecasted the historic near-term market bottom, issuing a further Precision Pivot OTAPS re-entry price point of $287.75 on the US S$P500 SPY ETF as a proxy point indicator, for Monday March 24TH 2020! (with the up-sloping "Wilbur Winged W Formation" financial technical analysis price bottom confirmation pattern, launching the most recent bull market wave lasting the next seven quarters!!)

(See https://wilburwingedwchartpattern.blogspot.com/)

And then in December 2021, and reiterating strongly the first week of January 2022, Kevin again called for the application of FULL price level hedge insurance on US Broad Market Index Equities exposures, again enabling prepared parties the prevention of significant equity value loss into mid-March 2022, the end of June 2022, and again into the end of September 2022! !

This outstanding pace and reach of Kevin's valuable and lauded commentary and analysis and his remarkable record of timely and effective market forecasts and alerts, issued for the benefit and interests of market scholars, market professionals, and active market enthusiasts alike, continues to this day!

Author Of Articles Published And/Or Featured In 2012 Through 2025 At

and many many more.

FURTHER BIO

Kevin attended the College of William and Mary as an undergraduate, earning his Double-Major. As a Senior, he was selected by William and Mary (along with only one other undergraduate student) to enjoy the privilege of attending class his last semester additionally at the Marshall-Wythe School of Law, The United States of America's prestigious oldest extant Law School.

Kevin grew up and attended High School in Fairfax County, VA. His formative High School achievements and interests also included a plethora of honor societies, clubs, organizations, and awards. At Commencement Kevin was awarded three (for the first time in the history of his high school) different Senior Graduating Day Highest Honor Awards and Plaques: in Service, in Citizenship, and in Social Studies. Kevin was also a Key Club President, a Letterman and District Medal Event Winner in Track and Field, and also earned the Eagle Scout Award. Kevin remains a member of NESA (The National Eagle Scout Association) to this day.

Kevin is married, and currently lives with his beloved wife and their three children in sunny Florida, USA.

*With ProtectVEST And AdvanceVEST By EchoVectorVEST MDPP Precision Pivots, Kevin has led the design and engineering of an applied methodology seeking to enhance major market exposed portfolio value security and overall portfolio value performance and return through the application and utilization of specialized derivatives as 'portfolio value insurancing hedges' when also combined with the power of the Motion Dynamics and Precision Pivots Forecast Model and Alert Paradigm and the ProtectVEST And AdvanceVEST By EchoVectorVEST MDPP Precision Pivots Active Advanced Position and Risk Management Trade Technology and Active Advanced Position Management And Capital Gain Return Optimization Methodology.

President and Founder

MEMBERSHIPS AND AFFILIATIONS

PROTECTVEST AND ADVANCEVEST BY ECHOVECTORVEST MDPP PRECISION PIVOTS

DIRECT LINKS "Positioning For Change; Staying Ahead Of The Curve; We're Keeping Watch For You."

The Motion Dynamics and Precision Pivots Forecast Model and Alert Paradigm, and the

ProtectVEST and AdvanceVEST By EchoVectorVEST MDPP Precision Pivots Active Advanced Risk Management Trade Technology and the Active Advanced Management Position Value Optimization

Method.

SEE CHARTS, ANALYSIS, AND FORECASTS AT

TWITTER OPTIONPIVOTS

TWITTER PROTECTVEST

TWITTER PRECISION PIVOTS

Prior President, Theta Chapter

OMICRON Delta Epsilon

The International Honor Society for Economics

AMERICAN ECONOMIC ASSOCIATION

"Keeping Ahead Of The Curve; We're Keeping Watch For You"

Special Notation

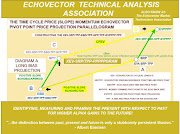

Kevin John Bradford Wilbur is the postulator of Time Cycle EchoVector Theory, the creator of Time Cycle EchoVector Analysis, and the inventor of Time Cycle EchoVector Pivot Points.

Time Cycle EchoVector Theory is a price pattern formation and impact theory. Time Cycle EchoVector Analysis is a powerful and advanced behavioral economics and financial markets technical analysis approach and forecast methodology, and applied active advanced position and risk management technology. Time Cycle EchoVector Analysis is also presented as a behavioral economics application and securities analysis tool in financial markets price pattern formation, in financial markets price pattern behavior, study, and forecasting, and in financial markets securities analysis, price analysis, and in securities price speculation.

EchoVector Pivot Points, special contributions to the field of financial markets technical analysis, are a technical analysis tool and application within EchoVector Analysis, and derived from EchoVector Theory in practice.

Copyright 1985 - 2025

PROTECTVEST AND ADVANCEVEST BY ECHOVECTORVEST MDPP PRECISION PIVOTS.

POPULAR PUBLISHED ARTICLES - FEATURED YEARS 2013 TO 2023

on TUE, March 21, 2022

• SPX, SPY, /ES SDS, SSO, DJI, DJX ,DIA /YM, $RUT, IWM, /RTY, NDX, QQQ, /NQ •

MARKET ALPHA NEWSLETTER GROUP ARTICLE NOW FREELY AVAILABLE GLOBALLY

on SUN, March 20,2022

• SPX, SPY, /ES SDS, SSO, DJI, DJX ,DIA /YM, $RUT, IWM, /RTY, NDX, QQQ, /NQ •

MARKET ALPHA NEWSLETTER GROUP ARTICLE NOW FREELY AVAILABLE GLOBALLY

on SUN, March 20, 2022 7:32 AM ET

• SPX, SPY, /ES SDS, SSO, DJI, DJX ,DIA /YM, $RUT, IWM, /RTY, NDX, QQQ, /NQ •

GLOBALLY PUBLISHED AND SYNDICATED ARTICLE

on THU, March 17, 2022 11:05am

• SPX, SPY, /ES SDS, SSO, DJI, DJX ,DIA /YM, $RUT, IWM, /RTY, NDX, QQQ, /NQ •

GLOBALLY PUBLISHED AND SYNDICATED ARTICLE

on SUN, Jun 14, 2015

PREMIUM MARKET ALPHA NEWSLETTER GROUP ARTICLE NOW FREELY AVAILABLE GLOBALLY

on TUE, Mar 11, 2014 • DIA, IYM, SPY, IWM, QQQ •

GLOBALLY PUBLISHED AND SYNDICATED ARTICLE

on WED, Feb 26, 2014, With THU Update • GLD IAU, GTU, NUGT, SLV •

PREMIUM MARKET ALPHA NEWSLETTER GROUP ARTICLE NOW FREELY AVAILABLE GLOBALLY

on WED, Feb 25, 2014 • GLD, IAU, GTU, NUGT, SLV •

PREMIUM MARKET ALPHA NEWSLETTER GROUP ARTICLE NOW FREELY AVAILABLE GLOBALLY

on TUES, Feb 25, 2014, w/ FRI UPDATE • GLD, GTU, NUGT •

PREMIUM MARKET ALPHA NEWSLETTER GROUP ARTICLE NOW FREELY AVAILABLE GLOBALLY

on , Jan 12, 2014 • GLD, IAU, GTU, NUGT, SLV •

PREMIUM MARKET ALPHA NEWSLETTER GROUP ARTICLE NOW FREELY AVAILABLE GLOBALLY

on WED, Aug 1 • DIA, IYM, SPY, IWM, QQQ •

GLOBALLY PUBLISHED AND SYNDICATED ARTICLE

(First Published August, 2012)

on THU, Sept 1, 2013 * GLD, IAU, GTU, NUGT, SLV *

PREMIUM MARKET ALPHA NEWSLETTER GROUP ARTICLE NOW FREELY AVAILABLE GLOBALLY

on FRI, Aug 31, 2013 • GLD, IAU, GTU, NUGT, SLV •

GLOBALLY PUBLISHED AND SYNDICATED ARTICLE

on WED, Aug 28, 2013 • DIA, SPY, QQQ, IWM •

GLOBALLY PUBLISHED AND SYNDICATED ARTICLE

on THU, Aug 22, 2013 • SLV, GLD, NUGT •

GLOBALLY PUBLISHED AND SYNDICATED ARTICLE

on WED, Aug 14, 2013 • GLD, NUGT, IAU, GTU, SLV •

GLOBALLY PUBLISHED AND SYNDICATED ARTICLE

Price Action This Month?

on FRI, Aug 9, 2013 • GLD, NUGT, IAU, GTU, SLV •

GLOBALLY PUBLISHED AND SYNDICATED ARTICLE

on WED, Aug 7, 2013 • DIA, IYM,SPY, DIA, IWM,QQQ •

GLOBALLY PUBLISHED AND SYNDICATED ARTICLE

on MON, Aug 5, 2013 • TLT, BOND •

GLOBALLY PUBLISHED AND SYNDICATED ARTICLE

on WED, Jul 31, 2013 • SLV, AGOL, GLD •

GLOBALLY PUBLISHED AND SYNDICATED ARTICLE

on MON, May 31, 2013 • GLD, GTU, IAU, NUGT, SLV •

GLOBALLY PUBLISHED AND SYNDICATED ARTICLE

POPULAR PUBLISHED ARTICLES - SELECTED YEAR 2012

August 1, 2012 | includes: DIA, SPY

July 13, 2012 | includes: SPY, DIA

May 21, 2012 | includes: DIA, SPY

May 21, 2012 | includes: SPY, DIA

May 21, 2012 | includes: SPY, CSCO, DIA

May 11, 2012 | includes: DIA, SPY

May 8, 2012 | includes: DIA, SPY

May 7, 2012 | includes: SPY, DIA

May 4, 2012 | includes: SPY, DIA